Tax season came a little late this year but taxes have long been at the forefront of the minds of many American adults. Although taxes may not be the first component that one ponders when thinking about where they may want to live, they’re definitely an important factor to consider. After all, your income can only have so much of an impact on your quality of life if a large percentage of it is being taxed. There’s also the consideration of sales tax and potential “dividends” that could actually come your way if you choose to live in a certain state. Needless to say, there are several different factors that play into what makes a state tax-friendly and all of these can have a significant impact on one’s livelihood. These U.S. states are the most tax-friendly you’ll learn about.

1. Wyoming

A state with beautiful sunsets surrounded by gorgeous mountaintops that also fares very well in terms of taxes, Wyoming residents enjoy an effective state tax rate of only 4.79% and also benefit from levies on mining and oil. Wyoming has the lowest tax burden of all the states, taking only 4.8% of a $60,000 income, or $2,876. There is no Wyoming state income tax, sales taxes are low but automobile taxes can be significant. Real estate property taxes are low too and Social Security income is not taxed. Wyoming is able to meet budgetary obligations with no revenue from income tax, partially due to taxes on the state’s natural resources.

2. Tennesee

A couple of the benefits of picturesque Tennessee is that it does not have a standard income tax and property taxes are quite low. Another positive point is that Tenessee Social Security retirement benefits and income from retirement accounts are not taxed at the state level. The effective rate for state taxes is a low 5.21% but one downside is that sales taxes are extremely high. Tenessee has the highest sales tax and the typical resident earning $60,000 will only pay $3,100 in overall state taxes.

3. Alaska

The Northern Lights and beautiful scenery are only a couple of the positive aspects of this gorgeous place. Alaska is third on the list with an average 5.99% state tax burden. Not only this, but residents actually receive an annual “dividend” payment that stems from levies on state oil drilling operations. For this year, the dividend is approximately $1,000 although it changes from year to year. Need more of a reason to consider this chilly but gorgeous state? There is no income tax!

4. South Dakota

Home to the beautiful Badlands National Park, South Dakota comes in fourth place with an effective state tax rate of 6.39%. There is no state income tax and the average sales tax is $832. The sales tax and real estate taxes are average but the state has some of the lowest auto taxes in our comparison.

5. North Dakota

Known form long roads surrounding farms and grasslands, North Dakota comes in fifth place with an effective state tax rate of 6.43%. The state does have an income tax but it is one of the lowest included in our top ten list. North Dakota also has some of the lowest sales and automobile taxes.

6. Florida

Sunny, beachy Florida, like many others has no state income tax and also has an effective state tax rate of 6.53% and no state income tax. The sales taxes and real estate taxes are average among all states and auto taxes are fairly low too. Florida is also friendly for retirees due to the fact that Social Security retirement benefits, pension income, and income from an IRA or 401(k) are all untaxed. Florida also has no estate or inheritance tax, and sales tax rates are close to national parks.

7. Nevada

Nevada has an effective rate of 6.76% for all state taxes, or $4,058. A major casino destination, gaming taxes account for 27% of the state’s general revenue funds. Because Nevada is one of the states with no income tax, the state depends more on other taxes. Nevada’s sales tax rate is among the highest in the country, with much of the revenue coming from tourist spending. Automobile taxes are some of the highest in the United States.

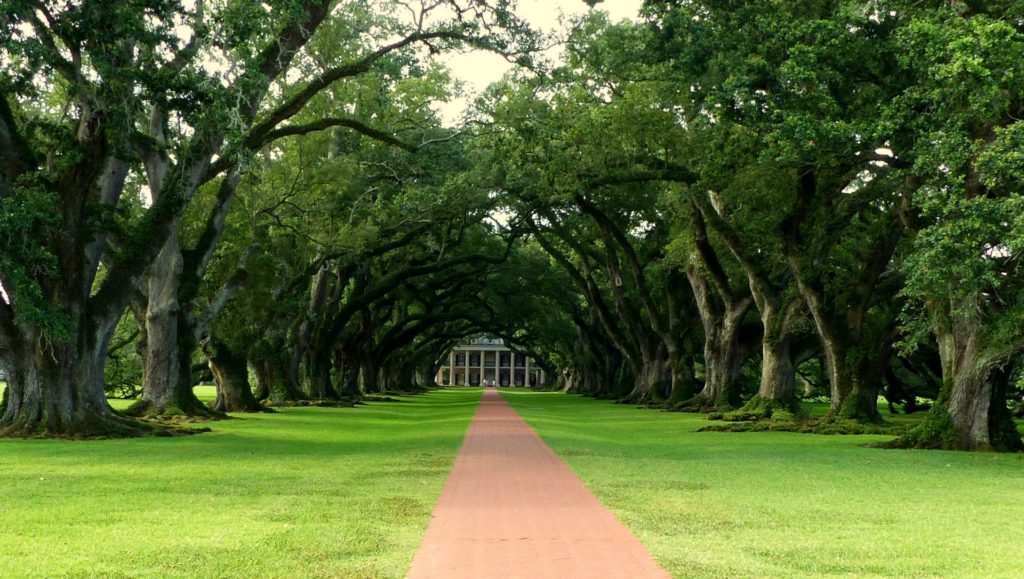

8. Louisiana

Known for its many festivals such as the New Orleans Jazz & Heritage Festival, Louisiana comes in 8th place in terms of tax-friendliness. The state has a 6.9% effective rate for state taxes but it’s important to consider that the state income and sales taxes are quite high compared to some of the other states listed above. Louisiana is known for being tax-friendly towards retirees because social security income is not taxed. Louisiana has some of the lowest state income taxes, real estate taxes, and auto taxes in the U.S. but the second-highest sales taxes in the country.

9. Alabama

The state of the longleaf pine tree, Alabama is next on the list with a 7.45% effective state tax. The income tax is highest on our list of the most tax-friendly states but average for the United States. Sales taxes in Alabama are also fairly high compared to other states on this list. A redeeming factor is that similar to Louisiana, social security income is not taxed. Alabama also has the lowest real estate taxes among all states and the auto taxes are the tenth lowest in the country. Sales taxes are the seventh-highest in the country.

10. Oklahoma

Known as the state where the shopping cart was invented, Oklahoma comes in close after Alabama with a 7.71% effective state tax rate. Oklahoma is also tax-friendly toward retirees in particular. Social security income is not taxed, income is taxed at rates close to the U.S. average, and real estate property taxes are among the lowest in the U.S.

Also on Coast to Coast

-

Sara Blakely Sends 1,000 Girls to “Camp Invention” This Summer

-

Episode 27 of Coast to Coast: Checking out the Galleri Classic & Summer Travel Inspiration with Dalia Colón!

-

Episode 26 of Coast to Coast: Exploring The Thermal Club’s $1 Million Challenge & the Top Cocktails for Spring!

-

Coast to Coast Kicks Back at GBK Brand Bar’s Pre-Oscar Luxury Lounge

-

Spring Vacation Inspiration with Travel Expert Stacie Jacob